Gold Market Cap: Trends and Insights for 2025

The gold market has been a focal point of investor interest in recent years, with prices reaching historic highs and demonstrating remarkable resilience. As we delve into 2025, several key factors are shaping the outlook for gold, including geopolitical tensions, economic uncertainties, and market dynamics. This article explores the current trends in the gold market cap and provides insights into what investors can expect in the coming year.

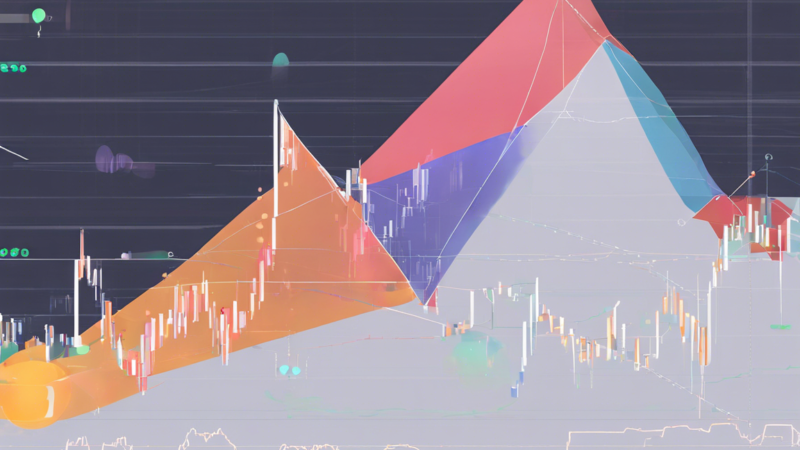

Recent Developments in Gold Prices

Gold prices have been on an upward trajectory, with spot gold reaching $2,773.57 per ounce as of January 24, 2025, and U.S. gold futures climbing 0.6% to $2,781 per ounce[3]. This surge is driven by a weaker dollar, uncertainty over U.S. President Donald Trump’s trade and monetary policies, and global interest rate movements.

Key Drivers Behind the Rally

- Weak Dollar: The dollar’s decline has made gold more affordable for foreign buyers, fueling demand[3].

- Trump’s Policies: Uncertainty over Trump’s trade policies, including potential tariffs on Chinese goods, has heightened market volatility and pushed investors toward gold as a safe haven[4].

- Global Interest Rates: The Bank of Japan raised rates to levels not seen since the 2008 financial crisis, and markets await decisions from the U.S. Federal Reserve and European Central Bank[3].

Expert Perspectives

According to Kyle Rodda, a market analyst at Capital.com, “The trend for gold remains bullish, and we are on track to hit the $3,000 per ounce milestone this year[3].” Renisha Chainani, Head of Research at Augmont, emphasized that gold is on the verge of a significant breakout due to economic uncertainties and inflation concerns[3].

The U.S. Debt Ceiling Crisis and Its Impact

The upcoming debt-ceiling negotiations in the U.S. are expected to create uncertainty, which historically drives gold prices higher. The current debt level and the potential for higher interest rates to finance new debt could lead to faster national debt accumulation and higher gold prices[2].

Investment and Trading Opportunities

Gold remains a stable and sought-after asset, making it an attractive choice for both investors and traders. For investors, gold acts as a hedge against inflation and currency devaluation, providing long-term value preservation. For traders, gold’s price fluctuations offer opportunities for profit, particularly during seasonal demand spikes[1].

Conclusion

The gold market cap is poised for continued growth in 2025, driven by geopolitical risks, economic uncertainties, and market dynamics. With experts projecting new record highs and the potential for gold to reach $3,000 per ounce, investors are advised to monitor key events like the upcoming Fed meeting and use dips as buying opportunities while maintaining a long-term perspective. As a safe-haven asset, gold remains a critical component of diversified portfolios, offering protection against inflation and economic instability.