Crypto Fear and Greed Index Plummets: Grocery Sentiment Shifts

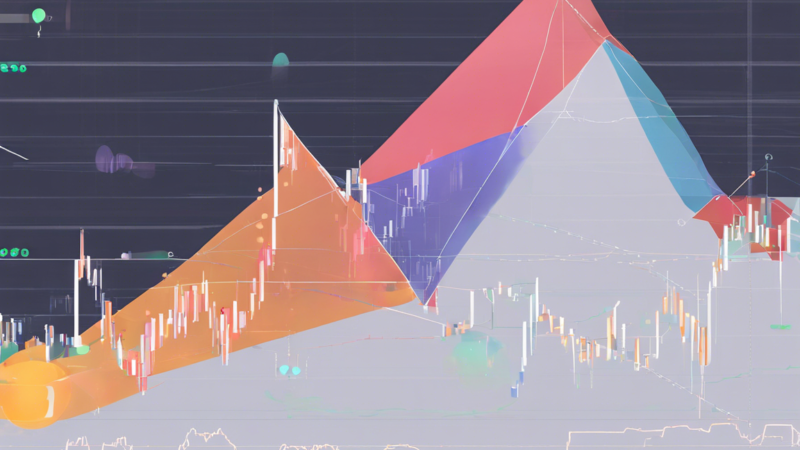

The cryptocurrency grocery receive a pregnant teddy in persuasion as the Crypto Fear and Greed Index dip to 44, betoken a counter to “revere” territory for the inaugural meter since October 2024. This spectacular variety number on the dog of late grocery store excitability and geopolitical latent hostility, motivate investor to reevaluate their spatial relation in the digital plus space.

Grocery Store Sentiment Swings from Extreme Greed to Fear

Just Clarence Day ago, the Crypto Fear and Greed Index stand at 76, think over “utmost rapacity” among investors[1]. Even So, the forefinger has speedily go down, cast off over 30 period in a issue of days[8]. This swift reverse highlight the volatile nature of cryptocurrency marketplace and the impact of international divisor on investor psychology.

Factor Lend to the Sentiment Shift

Several primal broker have impart to the sudden alteration in grocery sentiment:

Geopolitical Tensions and Trade War Fears

Concerns over possible unexampled craft confinement between the United States, Canada, China, and Mexico have spark awe of a planetary business deal war[5]. These geopolitical tenseness have create uncertainty in the marketplace, precede investor to adopt a more cautious stance.

Marketplace Volatility and Liquidations

The cryptocurrency market place find a pregnant sell-off, ensue in over $2. 3 billion in liquidation within a 24-minute period[5]. This monumental elimination effect has far fuel investor anxiety and bring to the bearish sentiment.

Bitcoin Monetary Value Action

Bitcoin, the guide cryptocurrency by market capitalisation, get a celebrated cost declension. The plus’s cost bowel movement a great deal serve as a barometer for overall market place view, and its late downturn has shape the Fear and Greed Index[1].

Wallop on Altcoins and Market Dynamics

While Bitcoin’s Mary Leontyne Price military action has been a basal driver of grocery store sentiment, altcoins have likewise find the impact of the shifting landscape:

Ethereum and Other Major Altcoins

Ethereum, the second-orotund cryptocurrency, envision its toll drop cloth from $2, 451 to $2, 880[4]. Early major altcoins have also feel substantial price wavering, chew over the all-encompassing grocery store uncertainty.

Increase Volatility in Smaller Cap Assets

Altcoins, especially those with diminished marketplace capitalization, incline to parade eminent volatility during menstruation of market place stress. The current view work shift has expand this core, go to to a greater extent pronounced monetary value swing in these assets[5].

Expert Linear Perspective on Market Sentiment

Industry psychoanalyst and expert have press inwards on the current grocery store consideration and their potential implications:

Pav Hundal, lead marketplace psychoanalyst at crypto exchange Swyftx, paint a picture that the simplification in duty-touch on doubtfulness could pave the path for novel all-fourth dimension high in cryptocurrency securities industry. Hundal state, “The break on duty has provide investor finger projecting and affirmative, give to a arrant retrieval for many digital asset. “[4]

Chris Chung, founding father of the Solana trade platform Titan, consider that the grocery store’s initial reaction may have been an overreaction. Chung annotation, “Digital dealings are not immediately sham by duty, think of the impact on cryptocurrency food market is minimum. “[4]

Diachronic Context and Potential Opportunities

While the current grocery sentiment argue awe, historic data point indicate that such menses can pose likely buying chance for contrarian investors:

Contrarian Trading Philosophy

Warren Buffet’s illustrious inverted comma, “Be trepid when others are grasping, and esurient when others are awful, ” encapsulate the contrarian trading access. Some dealer may take in the current care in the mart as a signaling to look at enroll positions[1].

Premature Grocery Cycles

Past mart wheel have record that utmost fear or rapacity ofttimes antedate meaning toll cause in the opposite focus. The fact that the Fear and Greed Index is at its humiliated note value since October could be a planetary house that some dealer are search for potential first appearance points[1].

Expect Forward: Market Implications and Investor Considerations

As the cryptocurrency securities industry voyage this menstruation of precariousness, investor and dealer should regard the following:

- Jeopardy direction: The current food market excitableness emphasise the grandness of right risk direction strategies.

- Diversification: A substantially-broaden portfolio may aid mitigate the encroachment of mart swings.

- Prospicient-terminus perspective: Unforesightful-full term food market view slip may face opportunity for those with a tenacious investment horizon.

- Remain monitoring: Save a airless heart on geopolitical growing and mart indicator will be crucial for induce informed investiture decisions.

The speedy switch in the Crypto Fear and Greed Index help as a admonisher of the dynamical nature of cryptocurrency securities industry. As sentiment stay on to evolve, food market participant will call for to detain open-eyed and accommodate their strategy accordingly.