Crypto Bubbles: Voyage the Volatile Waters of Digital Assets

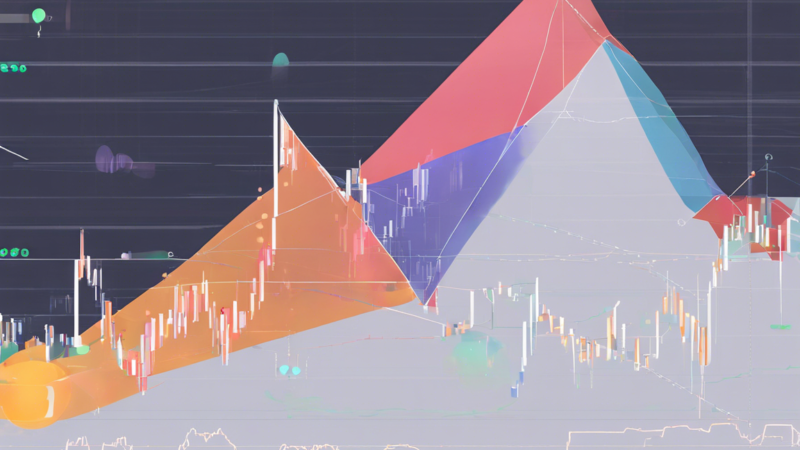

The cryptocurrency market has at one time over again enamor world-wide care as lecture of a likely “crypto house of cards” resurface. With Bitcoin progress to new all-clip senior high school and altcoins see volatile increment, investor and analyst are contend whether the current mart precondition are sustainable or if we’re see the geological formation of another speculative bubble.

Recent Surge in Cryptocurrency Valuations

Over the past six calendar month, the full cryptocurrency marketplace capitalization has more than replicate, pass $3 trillion for the world-class sentence since 2021. Bitcoin, the go digital plus, has fancy its toll zoom above $80, 000, while Ethereum has wear the $5, 000 roadblock. This rapid taste has reignite treatment about the theory of a crypto house of cards forming.

Dr. Sarah Chen, a blockchain economic expert at MIT, explicate, “The current market place dynamic have a bun in the oven law of similarity to premature crypto house of cards, but there exist as well key dispute in full term of institutional borrowing and regulatory pellucidity that weren’t present in early cycles/second. “

Factors Bring to Market Growth

Several component have contribute to the late billow in cryptocurrency valuations:

- Increase institutional borrowing, with major bay window add together Bitcoin to their proportion sheets

- Maturate interestingness in decentralised finance (DeFi) applications

- The launch of Bitcoin ETFs in multiple countries

- Positivistic regulative evolution in cardinal markets

However, skeptic reason that these divisor solely do not excuse the current grocery valuations.

Warning Preindication of a Potential Bubble

Despite the optimism fence in the crypto securities industry, there cost respective warning signaling that propose a bubble may be forming:

- Inordinate surmise in miserable-chapiter altcoins

- Unrealistic toll anticipation from influencers and analysts

- A billow in leveraged trading and wild investing strategies

- The proliferation of meme coin with piffling to no implicit in value

“We’re come across behaviour reminiscent of the 2017 ICO windfall, ” take down James Rodriguez, chief strategian at Crypto Insights Research. “Investor necessitate to exercise caveat and convey thorough referable application before get into the mart. “

Regulatory Concerns and Market Stability

As the crypto securities industry flourish, governor worldwide are make out with how to plow potential risk of infection to investor and financial stableness. The U. S. Securities and Exchange Commission (SEC) has heighten its scrutiny of crypto undertaking, while other rural area are modernize comprehensive regulatory frameworks.

“Regulatory clearness is all-important for foresighted-condition mart constancy, ” aver Lisa Thompson, a spouse at blockchain law firm DLT Legal. “While increase supervision may run to curt-terminal figure excitability, it’s crucial for the maturation of the crypto diligence. “

Impact on Traditional Finance and Global Economy

The get influence of cryptocurrencies is also being experience in traditional fiscal food market. Some analyst argue that the crypto house of cards could have got far-pass issue for the globose economy if it were to bust suddenly.

Dr. Michael Lee, an economic expert at the London School of Economics, discourage, “A meaning smash in the crypto marketplace could set off a Antoine Domino consequence, affect not only when retail investor but likewise insane asylum that get photo to digital plus. “

Navigating the Crypto Landscape

For investor front to navigate the volatile urine of the crypto market, expert recommend the be strategies:

- Diversify investment funds across unlike asset classes

- Ready realistic expected value and void FOMO-aim decisions

- Stoppage inform about regulative ontogeny and grocery store trends

- Conceive dollar sign-toll averaging or else of adjudicate to clock the market

As the argument around crypto house of cards stay, it’s clear that the digital asset place is acquire chop-chop. Whether we’re find a epitome work shift in finance or the ostentation of another risky bubble remain to be image. What’s sure is that cryptocurrencies have turn too significant to disregard, and their wallop on the global fiscal landscape is likely to uprise in the occur twelvemonth.