Bitcoin Value Today: Market Trends and Future Projections

The cryptocurrency market has been abuzz with the recent inauguration of Donald Trump as President of the United States, a development that has sparked fresh capital inflows and driven the market capitalization to near all-time highs. As of January 24, 2025, Bitcoin (BTC) is trading around $105,710.29, following a 2.68% decline the previous day. This article delves into the current state of Bitcoin, its recent price movements, and expert predictions for the future.

Recent Price Movements

Bitcoin experienced a significant price drop on January 23, 2025, falling by 2.68% in the last 24 hours. Despite this decline, the cryptocurrency still shows an increase of 2.74% on the week. The market is characterized by volatility, with daily lows at $101,470 and highs at $103,698.88. The total market capitalization of Bitcoin stands at approximately $2.03 trillion, reflecting strong investor interest despite recent price fluctuations[1].

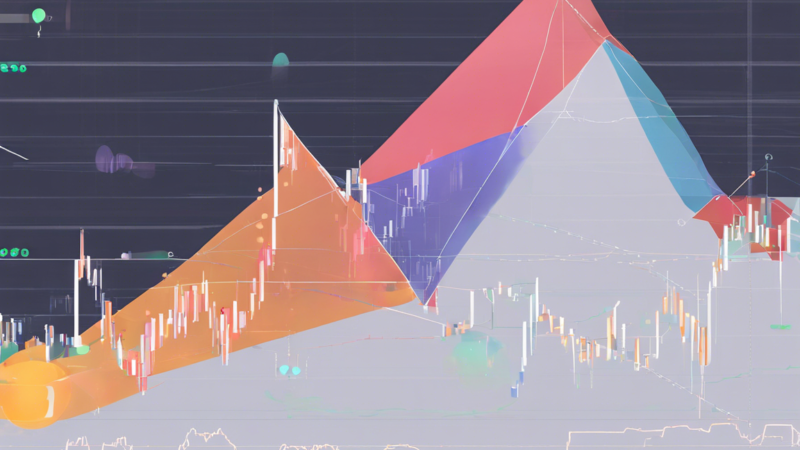

Technical Analysis

Technical indicators suggest a short-term bullish trend for Bitcoin. Moving averages indicate pressure from buyers, and prices have broken through the signal lines upwards, indicating potential continued growth. The Relative Strength Index (RSI) is currently at 58, indicating bullish momentum but approaching overbought conditions. Key support levels are at $102,400, $99,500, and $90,000, while the main resistance level is at $106,431.34[2].

Expert Predictions

Experts predict significant upside potential for Bitcoin, with some projections suggesting the price could reach $117,374.18. Positive market sentiment and institutional interest in Bitcoin are key factors in this projection. The recent inauguration of Donald Trump, who has expressed pro-crypto stances, could further boost investor confidence in Bitcoin[3].

Impact of FOMC Policy

The Federal Open Market Committee (FOMC) policy decisions could significantly impact Bitcoin prices. If the FOMC announces a decision to maintain or raise interest rates further, Bitcoin prices could experience a further decline as investors shift to safer assets. Conversely, signals of relaxed monetary policy could increase interest in Bitcoin as a risk asset, potentially pushing the price up[1].

Market Outlook

The global cryptocurrency market has been driven by Trump’s inauguration, with the market capitalization nearing its all-time high valuation of $3.7 trillion. The Foresight Ventures report highlights AI, consumer payments, and memecoins as key sectors to watch in 2025. The AI and memecoins sectors scored over 185% and 83% gains, respectively, in 2024[5].

Conclusion

The current state of Bitcoin is characterized by volatility and significant price movements. Expert predictions suggest a bullish trend, driven by positive market sentiment and institutional interest. The impact of FOMC policy decisions and the recent inauguration of Donald Trump could further influence Bitcoin prices. As the market continues to evolve, investors are advised to remain alert to market developments and news that may affect prices.

Key Points:

- Bitcoin Price: Trading around $105,710.29 as of January 24, 2025.

- Recent Price Movement: 2.68% decline in the last 24 hours, but a 2.74% increase on the week.

- Technical Analysis: Short-term bullish trend, with key support levels at $102,400, $99,500, and $90,000.

- Expert Predictions: Potential to reach $117,374.18, driven by positive market sentiment and institutional interest.

- FOMC Policy Impact: Could influence Bitcoin prices, with potential for further decline if interest rates are raised.

- Market Outlook: Global cryptocurrency market capitalization nears all-time high of $3.7 trillion, with AI and memecoins sectors showing significant gains.

In conclusion, the current state of Bitcoin is marked by significant price movements and a bullish trend. Investors should remain vigilant to market developments and news that may affect prices, as the market continues to evolve.