Bitcoin Converter Trends: 2025 Outlook and Key Developments

The world of cryptocurrency is witnessing significant transformations, with the bitcoin converter playing a pivotal role in these changes. As we delve into 2025, several key developments are shaping the future of bitcoin, including enhanced institutional adoption, regulatory clarity, and technological advancements. This article explores the latest trends and their implications for the bitcoin converter landscape.

Institutional Adoption: A Key Driver

Institutional adoption has been a major catalyst for bitcoin’s growth in 2024, and this trend is expected to continue in 2025. The approval of bitcoin spot ETFs has paved the way for more institutional participation, with traditional financial institutions increasing their bitcoin allocations[1][4]. For example, insurance companies are beginning to make small investments, while pension funds are testing the waters with pilot programs. Family offices, known for their flexibility, are likely to expand their exposure to digital assets.

Regulatory Clarity: A New Era

Regulatory developments are also playing a crucial role in shaping the bitcoin converter landscape. The Trump administration’s support for crypto, including the nomination of pro-crypto figures like Paul Atkins as SEC chair, signals a shift towards an innovation-friendly approach[1][3]. The Markets in Crypto-Assets (MiCA) regulation in the EU has also provided increased legitimacy and security for the European crypto market.

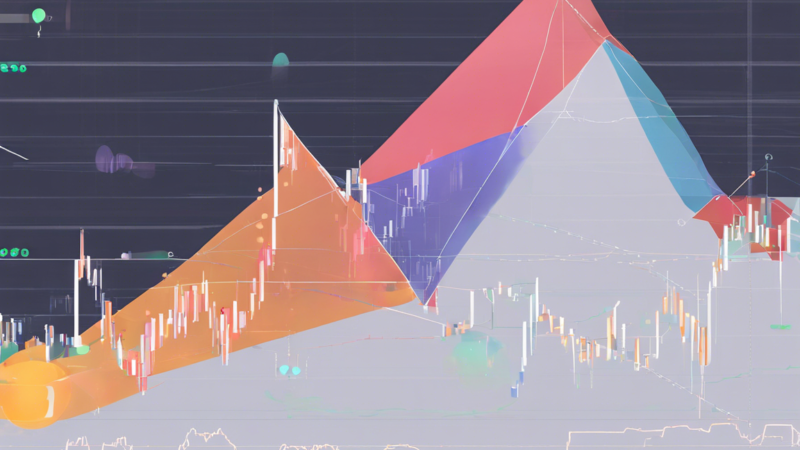

Technological Advancements: Enhancing Utility

Technological advancements are improving bitcoin’s utility, scalability, and privacy. Layer 2 solutions like the Lightning Network offer near-instant transactions with reduced costs, making bitcoin a more viable medium of exchange[2][4]. New layer 2 technologies such as Fedimints and Ark are also maturing, further enhancing bitcoin’s accessibility and security.

Expert Insights

According to Jason Tang, Petar Petrov, and Viga Liu from Mitrade, “Bitcoin’s 2025 outlook appears highly favorable, driven by institutional adoption and regulatory developments. The approval of Bitcoin spot ETFs has paved the way for more institutional participation and ETF fund inflows have shown a positive correlation with Bitcoin’s price[1].”

Marion Laboure from Deutsche Bank notes, “The Trump administration’s support for crypto means the market’s current bull run should continue, and ongoing presidential backing is key for the ‘continuation of crypto’s golden era[3].”

Conclusion

The bitcoin converter landscape is undergoing significant transformations, driven by institutional adoption, regulatory clarity, and technological advancements. As we move into 2025, these trends are expected to continue, shaping the future of bitcoin. With expert insights pointing to a favorable outlook, it’s clear that the bitcoin converter will play a crucial role in the evolving cryptocurrency landscape.

Future Developments

Looking ahead, several potential developments could further bolster bitcoin’s role in reshaping the financial landscape. These include the possibility of more ambitious policies like the National Bitcoin Reserve, comprehensive tax reform, and cross-border payment reform[1]. While these proposals face significant political and technical challenges, their potential significance cannot be overstated.

In conclusion, the bitcoin converter is at the forefront of the cryptocurrency revolution, with 2025 promising to be a year of significant growth and adoption. As institutional investors, regulatory bodies, and technological advancements continue to shape the landscape, it’s clear that bitcoin is here to stay.