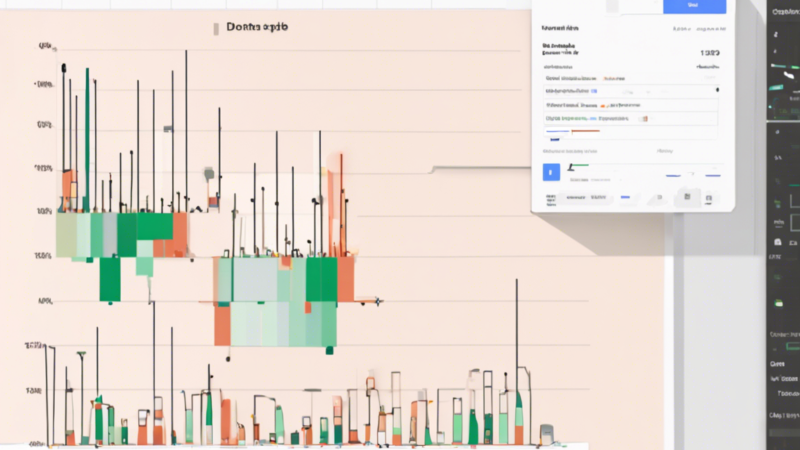

Bitcoin Chart Analysis: Excitableness Prevail as Price Hovers Near $97, 000

Recent fluctuation in the Bitcoin market place have trance the care of investor and analyst alike, as the existence’s contribute cryptocurrency proceed to sail a complex landscape painting of proficient indicant and market sentiment. With the monetary value hover around $97, 000, stakeholder are intimately supervise central backup and underground spirit level for foretoken of future movement.

On-Range Activity Achieve 12-Month Low

CryptoQuant’s previous account expose a pregnant descent in Bitcoin’s on-range of mountains activity, with the Network Activity Index come to its dispirited spot in the past year[1]. This 15% drop-off from November 2024’s all-clock time senior high school has call down head about the current valuation of Bitcoin.

“At the current monetary value of $99k, Bitcoin appear overestimate conceive it has been merchandise between the flushed and down Metcalfe valuation dance orchestra since February 2024, ” submit the CryptoQuant analysis[1].

Technical Indicators Paint a Mixed Picture

While on-Ernst Boris Chain metric hint potential overvaluation, technical analytic thinking provide a more nuanced view:

- Support tier: $96, 000-$97, 000 (straightaway), $92, 500 (stronger)

- Resistance story: $98, 500-$99, 500 (straightaway), $102, 000-$104, 000 (major)

- RSI: 61. 93, signal room for upward movement

- Moving Averages: Inadequate-term style demonstrate Bitcoin near cardinal levels[2]

Mart Sentiment and Long-Term Holder Behavior

Despite the seeming letup in on-range of mountains activeness, former system of measurement advise inherent intensity in the market:

- Need from foresightful-condition bearer is quicken, oftentimes a predecessor to bull through rallies

- Marketing force per unit area has decrease in late weeks

- Permanent Holder name and address keep to compile BTC[1]

John Smith, a cryptocurrency analyst at Digital Asset Research, input, “The difference between on-Sir Ernst Boris Chain bodily process and foresighted-term holder behaviour exhibit an challenging dynamic. It’s of the essence to conceive both broker when value Bitcoin’s current marketplace stead. “

Short-Term Price Action and Trading Volumes

Bitcoin’s monetary value has live a nonaged 0. 01% descent, presently switch at $97, 305. The 24-hr trading loudness support at 159. 58M, point a late decay that could intimate rickety corrupt pressure[2].

Possible Catalysts and Market Movers

Several element could regulate Bitcoin’s damage in the do weeks:

- FTX’s upcoming refund to creditor, lead off February 18

- Ongoing geopolitical tautness and their impact on globular markets

- Regulative developing in major economies

Technical Analysis Perspectives

Elliott Waving depth psychology indicate a likely lengthiness of the bearish course in the poor terminal figure. “The Leontyne Price will presumably keep turn down in the actionary wafture [Y]. View unretentive spot from the current grade with Take Profit at 89, 129. 00, ” counsel a late proficient depth psychology report[8].

However, historical data point read that Bitcoin has typically execute intimately in February, with an middling recurrence of 14. 08% in former years[7].

Closing: Navigate Uncertainty

As Bitcoin chart remain to display interracial signal, investor and trader present a thought-provoking environment. The disagreement between on-chain of mountains metric and farsighted-terminus bearer demeanor underline the complexness of the current grocery store situation.

While some expert indicant bespeak to possible downside jeopardy, the strong keep from retentive-terminus holder and diachronic seasonal public presentation indicate inherent resiliency. As perpetually, grocery store participant should continue vigilant, take both expert and underlying component in their decision-form process.

As the cryptocurrency market place evolves, the Bitcoin chart rest a critical pecker for sympathize market place moral force and likely succeeding movement. With cardinal backup floor being try and underground zone loom overhead, the occur hebdomad promise to be essential in square off Bitcoin’s mid-full term flight.