Are Bitcoin and old coins facing relaxation?

The crypto market gives some bullish signals in the second half of April 2025. So there are several divergences that have a potential recovery for Bitcoin and indicate old coins.

Divergence is a key concept in data analysis. It occurs when the values of two metrics suddenly shift and move into opposite directions compared to their previous trend. This often signals a change in price moment. Based on expert analyzes and market data, this article emphasizes five important divergences – three for Bitcoin And two for old coins – to convey a better understanding of the market prospects.

3 divergences in April indicate a Bitcoin rally

Historically, move Bitcoin and the DXY index (US dollar index) in opposite directions. When the DXY rises, tends Bitcoin To fall and vice versa. But from September 2024 to March 2025 there were moving Bitcoin And the DXY in the same direction.

This correlation broke in April when the United States announced a new customs policy. The inverse relationship seems to have returned.

Joe Consorti, Head of Growth at theyabitcoin, noticed that Bitcoin began to decouple from the US dollar after The announcement of the comprehensive customs regime. A diagram from his contribution shows that in April, while the DXY strongly fell from 103.5 to 98.5 Bitcoin from around $ 75,000 to over 91,000.

This divergence could reflect that investors Bitcoin view as a safe port in the middle of global economic uncertainties due to the tariffs.

„Bitcoin has decoupled from the US dollar since the announcement of the comprehensive customs regime of the United States. In the middle of this global economic reorganization, gold and Bitcoin“, Forecast Joe Consorti .

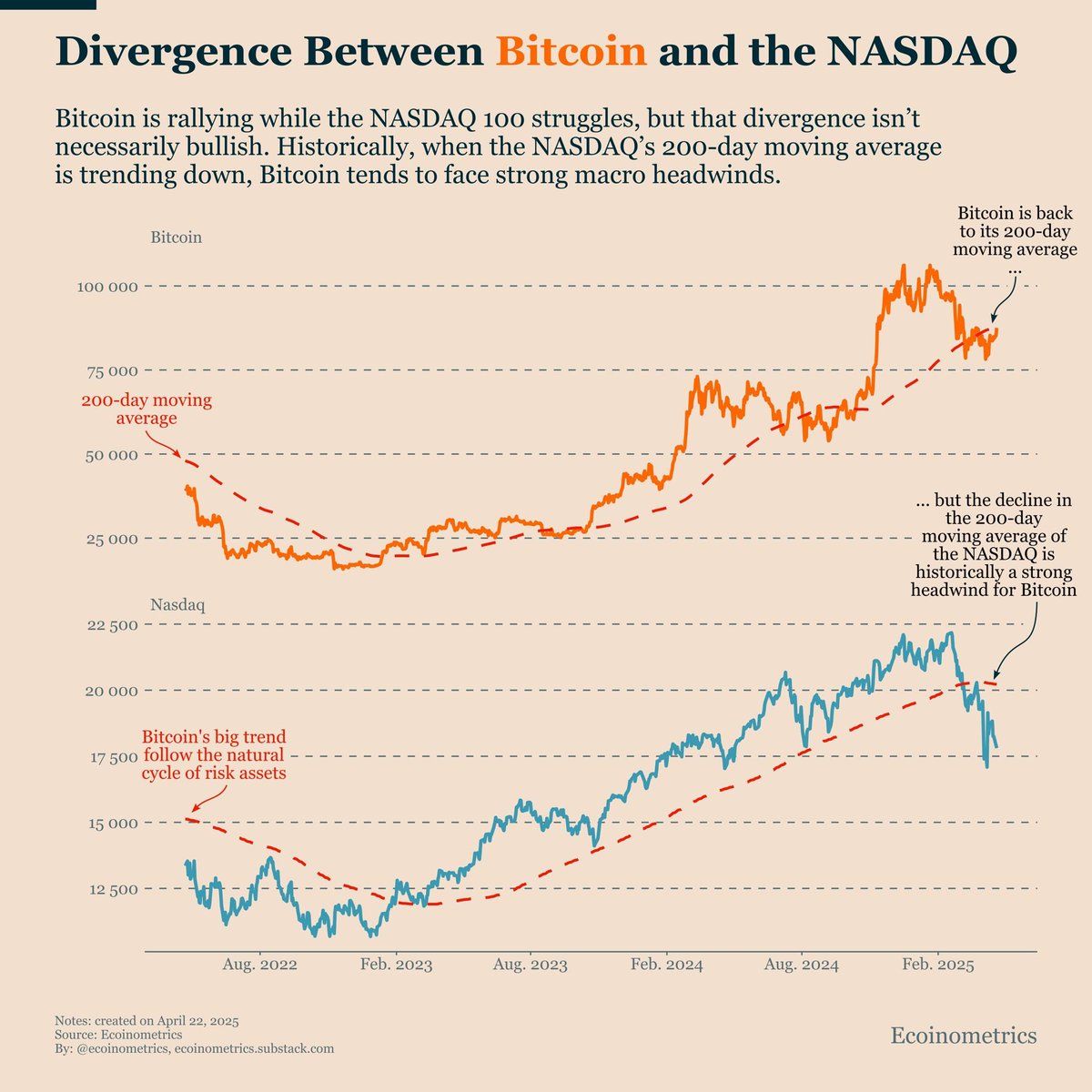

Another important divergence comes from Tuur Demeester, a consultant from Blockstream. He indicated A separation between Bitcoin and the NASDAQ index that represents technology values. Historically followed Bitcoin the Nasdaq due to its connections to Technology and macroeconomic mood tight.

But started in April 2025 Bitcointo show independent growth. It no longer moves synchronously with the Nasdaq. While some, like ecoinometrics, argueThe fact that this divergence is not necessarily bullish remains optimistic.

“Bitcoin divergence and Bitcoin decoupling will offer dominant headlines for 2025”, said Tour Demester.

The NASDAQ in particular is under pressure due to fear of interest and slow growth. Meanwhile has Bitcoin Presented strength with significant price gains. This indicates that Bitcoin His role as an independent asset, which is less bound by traditional markets.

Cryptoquant's data emphasize a further divergence – this time in investor behavior. Long-term Bitcoin owners (LTH, those who have been holding BTC for over 155 days) began to accumulate again after the latest local high.

In contrast, short -term owners (STH) sell. This divergence often signals the early phase of a reakcumulation phase and indicates a future increase in the course.

“Why is this divergence important? LTH behavior is generally associated with macroeconomic conviction, not with speculative movements. STH activity is often emotionally and reactivated, driven by price volatility and fear. If LTH battery affects STH capitulation, this tends to signal the early phases of a reakcumulation phase”, forecast It tech, an analyst at Cryptoquant.

Altcoin recovery is imminent: a good time to invest?

Differences also occurred in old coins, which indicates a positive short -term view.

Jamie Couts, Chief Krypto-Analyst at Realvision, pointed out an important divergence with the “365-day lowest floor” indicator. This metric follows how many old coins have reached their lowest point last year.

In April 2025, although the market capitalization of old coins fell to a new low, the number of old coins that reached the new 365-day deep stalls dropped significantly. Historically, this pattern is often preceded by a recovery of the Altcoin market capitalization.

“Diversity shows that downhill moment was exhausted”, said Jamie Coutts.

To put it more, fewer old coins that reach the low point means fewer panic sales. It indicates that the negative market mood subsides. At the same time, rising courses show again. These factors indicate that old coins could prepare for relaxation-or even for an “old coin season”, a phase in which old coins Bitcoin surpass.

Another technical divergence results from the RSI (relative strength index) on the Bitcoin dominance chart (BTC.D), noticed by analyst Merlijn the Trader. This chart reflects the proportion of Bitcoin in the entire crypto market capitalization.

“Bärische Divergenz on Btc.d discovered. Higher high on the chart. Lower highs on RSI. This setup does not lie. Altcoin strength is brewing together. Watch trade sets,” said Merlijn .

This pure technical divergence indicates that BTC.D could soon experience a strong correction. If this happened, investors could switch more capital into old coins.

The market capitalization of old coins (total3) recovered in April by 20 percent, from USD 660 billion to over $ 800 billion. The divergences discussed above indicate that this recovery could last.

Disclaimer

In accordance with the guidelines of the Trust Project, BeinCrypto commits an impartial, transparent reporting. This article aims to provide precise and current information. However, readers are recommended to check the facts independently and consult a specialist before making decisions based on this content.