These are the biggest crypto trends for 2025

2025 is likely to be a hot crypto year. Because on January 20, Donald Trump, who marketed himself as a crypto president, will begin his second term as the head of the strongest economic nation. In advance, he has already shown some personal details that he will pursue a pro crypto policy-possibly even with the result that the United States creates a Bitcoin reserve. In other countries there are now also voices to do the same to the United States.

But whether this will happen is still in the stars. The following trends that will shape the crypto year 2025 are really foreseeable:

Companies buy BTC

Michael Saylor from Microstrategy has shown it and increased the existence of the software company to 447,470 BTC worth around $ 45 billion. This has, at least for a few, role models. Now other companies such as the health company Cosmos Health or Solidion Technology have already moved out to also take Bitcoin on their own balance – with the aim of benefiting from further price gains.

The latest example is the investment company Metaplanet from Japan, which has decided to own 10,000 BTC by the end of 2025. Asia's leading Bitcoin Treasury Company would be wanted and the ecosystem around Bitcoin in the region grow.

Effects of Bitcoin Halving

He will double to $ 200,000 or fall down to $ 80,000: forecasts for the Bitcoin priest there are many. In addition to interest policy, Trump Trade, Tech shares and other economic factors, there is an effect that is to be used in 2025 in price development: Bitcoin Halving. This took place in early 2024 and ensures that fewer new BTC come onto the market. The economic theory then says very simply: falling offer with constant or increasing demand ensures increasing prices.

At the Bitcoin cycle, this-more or less-showed itself in the past BTChalvings in 2012, 2016 and 2020. More than a year after the Halving, there were new all -time highs for the most important cryptocurrency in the world. And that should happen this year too. Only when is a question of the calculation. And a completely different question is how US policy or any crises will affect price development. In any case: Many crypto enthusiasts believe that the cycle continues and that there can be a new all-time high at some point between August and October.

Memecoin Mania

No, 2025 will not do without Memecoins either. Dogecoin, Shiba Inu and Pepe are already known, but there are numerous other fun tokens, whose market capitalization of crypto founders who seriously mean their project, make it serious about envy. With pump.fun there is its own platform that is only there to put more memoins into the world on the Solana blockchain. One of the new promoters in the Memecoin area is Pengu, which was able to develop a fan base and currently has a market capitalization of more than two billion dollars.

But there is a particularly incredible story behind many Memecoin: Fartcoin For example, the “idea” of automated chatbots, which was then taken up to put a fun token into the world, which now weighs more than a billion Dolar Market Cap.

Even more crypto ETFs

In 2024 Spot brought ETFs for Bitcoin and then also for Ethereum, and now of course many other investment vehicles for other crypto-assets should follow. These mean that you can then invest very easily in crypto-assets on the stock exchange without having to buy or hold them directly. It is known, for example, that Grayscale submitted a “Grayscale Solana ETF” to the US stock exchange supervision SEC, and a decision will be expected on January 23.

Approval could be the first large official act under the new head of the US stock exchange supervision Sec, Paul Atkins. As reported, Atkins is more likely to be assigned to the Pro crypto warehouse, since he was co-chair at TOKEN Alliance, a lobby group for crypto-assets at the Digital Chamber of Commerce. He will replace the crypto-critical Gary Gensler, who departs early on the day of Donald Trump's office.

Token of Real World Assets (RWA)

It is actually an old hat of the crypto industry: in principle, everything can actually be designed for everything to make a specific product, good or service-real estate or precious metals are a good example of this. Under the abbreviation RWA (Real World Assets), this idea has now widened, and numerous crypto companies and startups are working to digitize the most tangible assets in this way.

Examples that have been on the market for a long time are Tether Gold or Pax Gold, where every token represents a certain amount of the coveted precious metal. Currently, Mantra benefits properly from the trend and wants to become home to everyone with its own layer 1 blockchain for everyone. If, for example, a company wanted to build a gemstone token, it could do that at Mantra. Here are some examples that are assigned to RWA:

Demin

Depin stands for Decentralized Physical Infrastructure Network and says the following: Physical machines such as cars, wind turbines, solar systems, data centers, servers, GPUs, etc. are shown on a blockchain using tokens – and thus invested. Unlike RWA, there are fewer things like gold or gemstones that can be traded by tokens, but about infrastructure, which should be used by tokens. A failed Austrian example is Eloop that had his users invested in his electric car fleet via token.

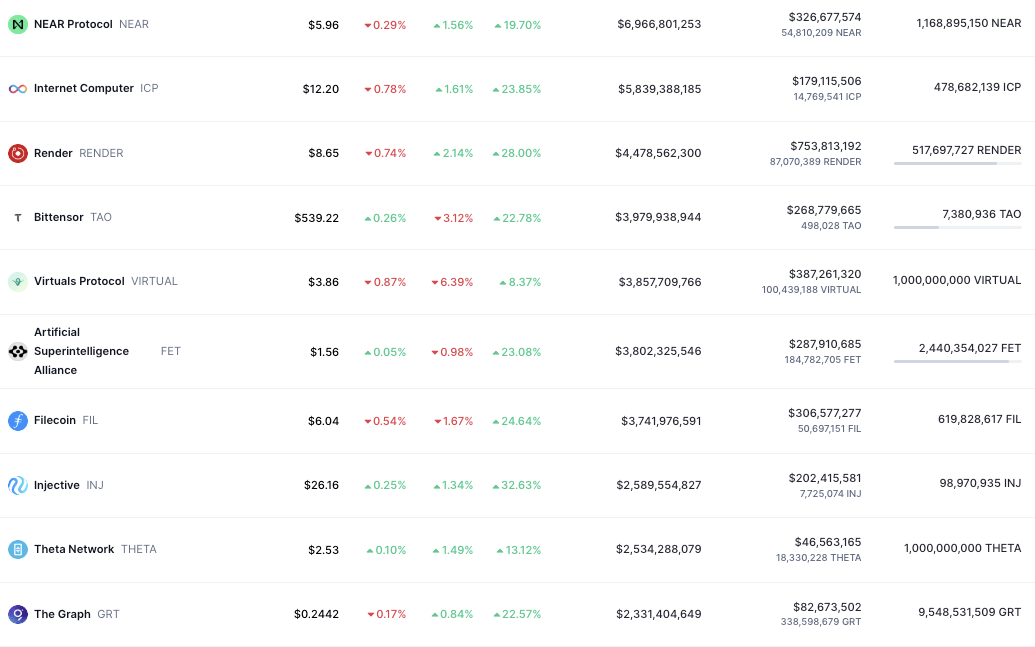

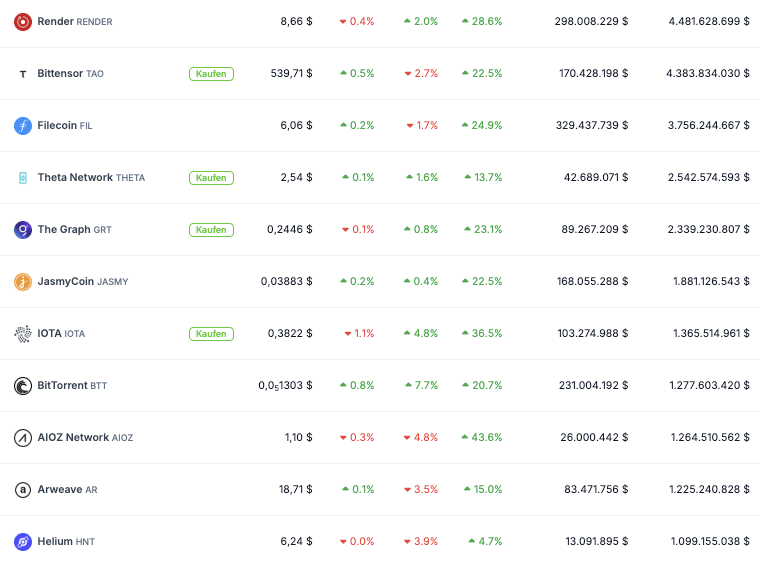

At the moment, the depin area is primarily buzzing in the cloud/AI sector, where it is about decentralizing the highly centralized systems around data centers. The render project is currently very benefiting from this. Render promises a distributed GPU rendering network that builds on the Ethereum and Solana blockchain with the aim of giving 3D designers favorable access to this graphic calculation power.

Stablecoins

With a profit of $ 10 billion, but only about 50 employees: Inside, Tether with the StableCoin Usdt has built the best business model in the world. Now the financial industry is getting more and more on the taste of stable coins – including because they enable cheap international transactions. The Boston Consulting Group predicts that account-to-account payments (A2A) will reach a market share of 30 percent worldwide by 2030. At the same time, it is expected that around 25 percent of all global transactions are based on blockchain technologies by 2026.

“Stable coins combine the advantages of cryptocurrencies – fast transactions and low costs – with the stability of traditional currencies. This development creates a bridge between the old and the new world of payments”, so For example, Roman PrziBylla is Head Investments at Maverix Securities (formerly Cat Financial Products), one of the leading Swiss securities houses. Mastercard, Visa, PayPal are already on the road in StableCoin Business, FinTechs such as Revolut, Stripe or Robinhood have already been interested in wanting to go into the market.

Ai-token

No question and no wonder, the AI area is also hot in 2025. Openai, Anthropic or Xai made huge financing rounds in 2024 and will probably put a lot of speed on the speed in 2025. Projects at the AI and crypto interface currently benefit twice, on one side from the new crypto hype and on the other hand from the crypto boom.

Request (Tao), render (render), Virtuals Protocol, Fetch.ai and some more have specialized in tok and decentralize everything related to cloud computing and AI agents. The largest startup in the area is Near Protocol, which has positioned itself as the blockchain for AI. The aim is to develop as the platform for everyone that builds at the AI and Web3 interface.