SHIB, DOGE and PEPE enter $6B gains as BTC aims at $90k

-

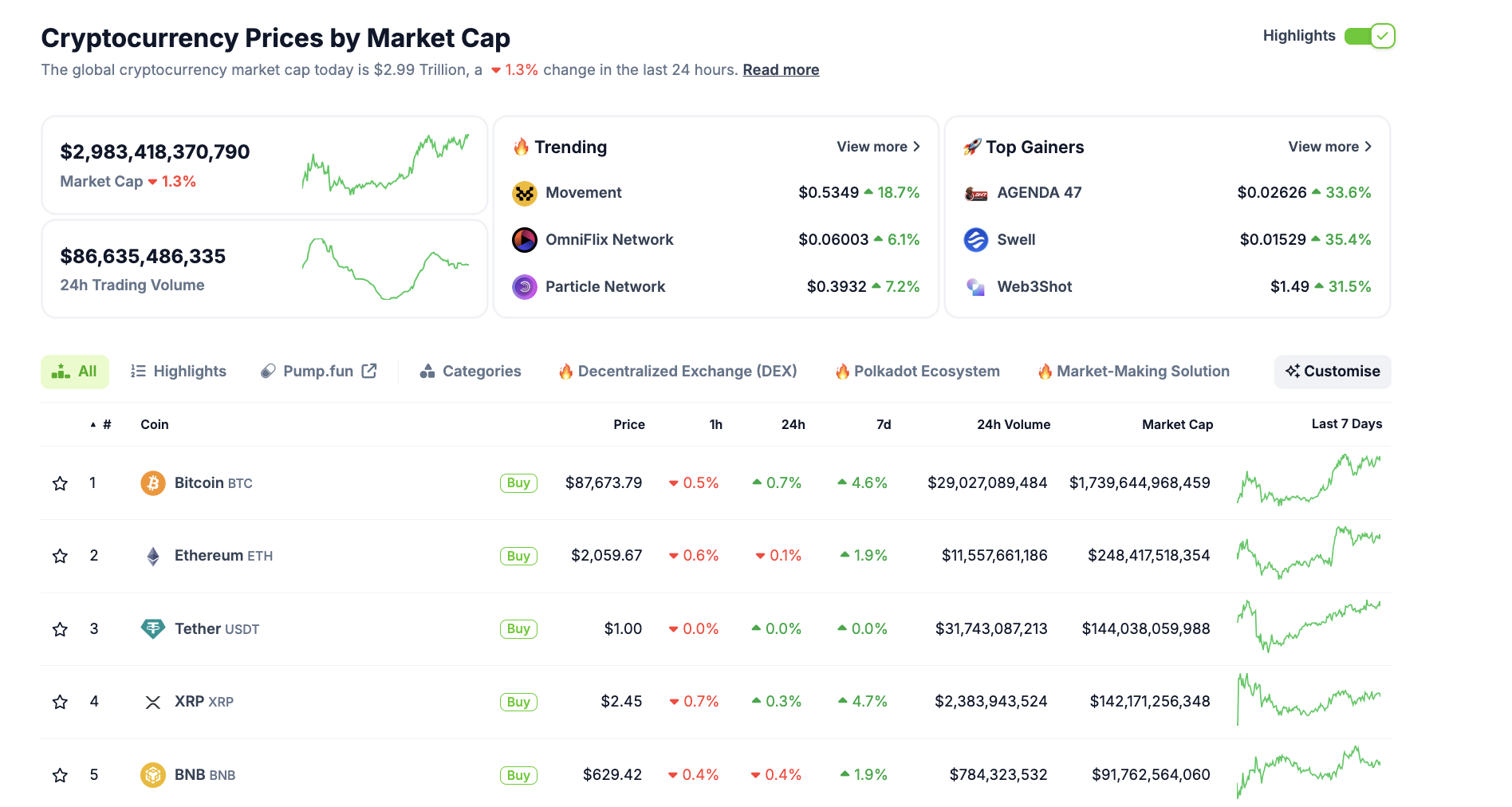

The entire market capitalization of cryptocurrencies fell by 1.3 % on Tuesday and is now $ 2.9 trillion. Market indicators indicate that capital is increasingly switched towards Memecoins.

-

The significant support of the official Trump token by Donald Trump on the occasion of his inauguration, which has noticeably strengthened investor confidence in memo cards this week, also ensured a fresh tailwind.

Bitcoin market update

-

The Bitcoin course fell $ 86,000 on Wednesday after another attempt failed to break the resistance at $ 90,000.

-

The decline of Bitcoin exceeded the decline of 1.3 % in the total cryptom market and indicates that investors withdraw capital from BTC and increasingly switch into old coins.

Bitcoin ETF Flows | Source: SosoValue

Since March 14, Bitcoin ETFs have had net inflows eight days in a row-a total of $ 887.47 million during this period.

On Tuesday, Blackrock announced the introduction of his first Bitcoin Exchange Traded Product (ETP) in Europe. At the time of going to the editor, the net assets of the IBIT BTC ETFS from Blackrock amounted to around $ 50.8 billion.

Many market participants expect that Blackrock's entry into Europe could further boost institutional demand for Bitcoin.

Altcoin market update: SUI and polygon on the upswing-rotation in mid-caps and memo cins

Driven by a tailwind after the zin break of the US Federal Reserve at the beginning of the week, old coins recorded strong inflows. However, with the exceeding of the 3-billion dollar brand, a consolidation phase used. Since the Bitcoin course moves further below $ 90,000, market dynamics have weakened significantly in the past 24 hours.

Crypto market performance, March 26 | Source: CoinMarketCap

Crypto market performance, March 26 | Source: CoinMarketCap

Instead of deducting capital, however, many traders relocate their means in sectors with strong market story and in niche values with high growth potential – by circumventing BTC and leading old coins.

Ripple (XRP), Solana (Sol) and Ethereum (ETH) were among the losers of the day and posted losses between 1 % and 3 %.

In the back ranks, however, SUI and polygon increased significantly among the 30 largest cryptocurrencies as a top performer-with price gains of 3 % and 5 %.

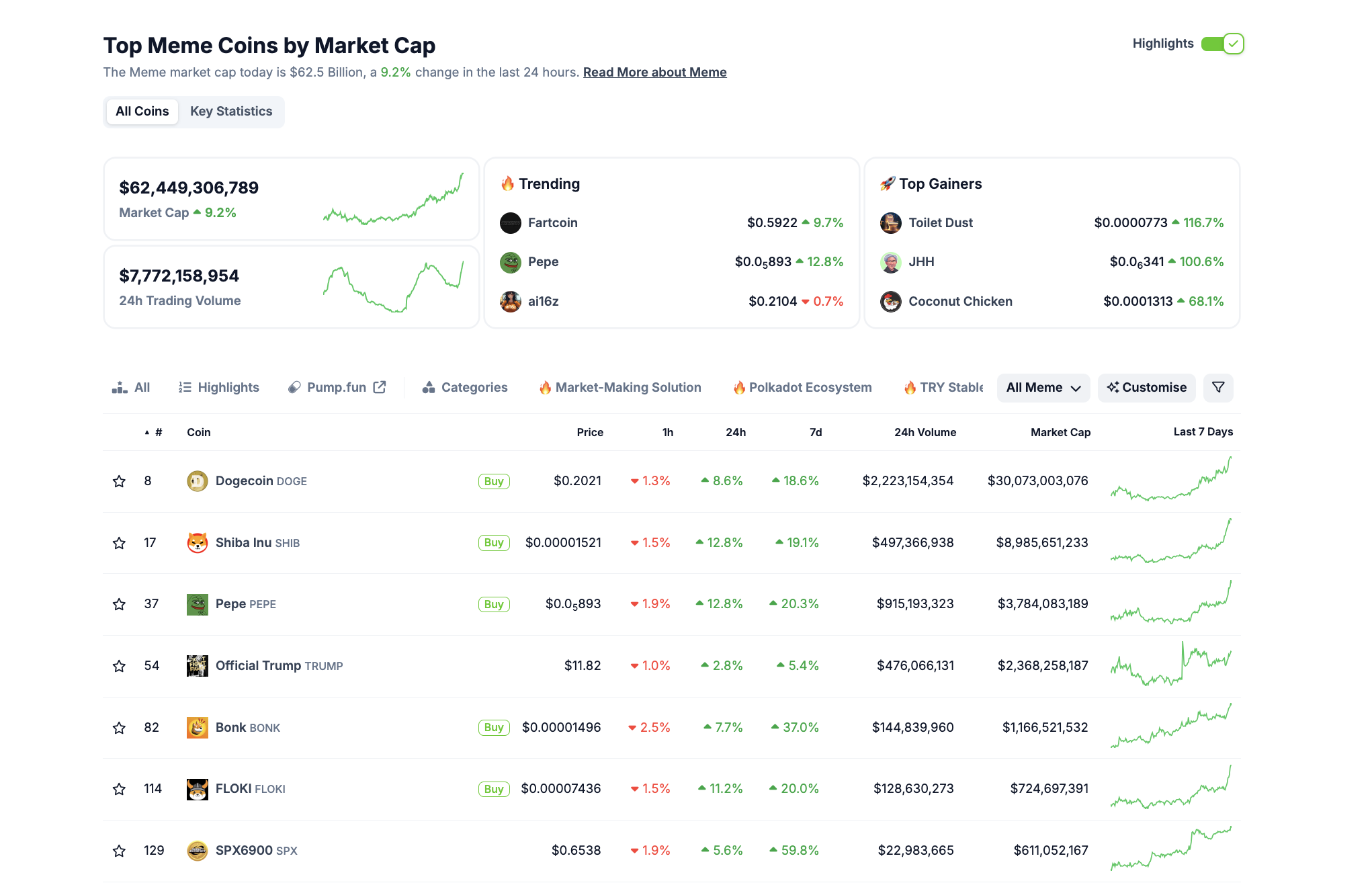

Chart of the day: Trump support drives Memecoin sector over $ 62 billion

The stagnation of the Bitcoin course near the $ 90,000 mark indicates a capital shift towards alternative crypto systems. After Donald Trump confirmed his support for the Memecoin $ Trump on Monday, he recorded the greatest capital inflow among the tokens-while the top assets were moving sideways.

Memecoin sector performance | Source: Coingecko

Memecoin sector performance | Source: Coingecko

This development is reflected in the course of the market: the entire market capitalization of Memecoins rose by 9.2 % and for the first time exceeded the threshold of $ 62.5 billion.

Among the leading Memecoins, Dogecoin, Pepe and Shiba Inu listed strong price gains:

-

Dogecoin (DOGE): Currently at $ 0.20, with a daily increase of 8.6 % and a weekly profit of 18.6 %. The market capitalization is now over $ 30 billion.

-

Pepe (pepper): The course rose by 12.8 % to $ 0.0000089 within 24 hours, with a weekly profit of 20.3 %-a sign of increasing speculative demand.

-

Shiba Inu (Shib): The token increased to $ 0.000015, which corresponds to a daily increase of 12.8 % and a weekly increase of 19.1 %. The market capitalization is approaching $ 9 billion.

While Bitcoin and Layer 1 projects such as ETH, XRP and SOL have losses, the strong demand in the Memecoin segment indicates a growing risk awareness of investors-supported by the recent zin break of the Fed. It remains to be seen whether this optimistic mood is on the market or Bitcoin's sideways phase triggers a correction.

Krypto-News-Update

SEC sets investigations against immutable without charges

The US stock exchange supervision SEC has officially discontinued its investigation against the Australian crypto company without charges.

The company, which had previously received a so-called wells notice due to possible violations of securities law, rated the outcome as an important victory for digital property rights in the gaming sector.

This decision is part of a series of fallen processes against large crypto companies in recent months.

Robinhood, Uniswap and Ripple also recently learned a loosening of the regulatory measures-since the SEC lead used by Trump took over the helm.

This change goes hand in hand with the endeavor of the US government to create clearer crypto rules-a clear break with the strictly implemented course under ex-sec boss Gary Gensler.

Fidelity launches US dollar-bound stablecoin and Ethereum-based fund class

Fidelity Investments plans the introduction of a stable coin coupled to the US dollar and an Ethereum-based shares for its US dollar money market fund.

Stablecoin is to be output via Fidelity Digital Assets – in accordance with the company's efforts to expand the range of blockchain -based financial solutions.

At the same time, the “Onchain” fund class was developed, which is based on Ethereum blockchain and is intended to enable improved tracking of transactions in the Fidelity Treasury Digital Fund.

With these initiatives, Fidelity positions itself in a market environment that is increasingly open to crypto assets-and is part of a growing number of traditional financial institutions that integrate blockchain technology into its products.