Bitcoin Live: Grocery Unpredictability Surge Amid Global Trade Tensions

Bitcoin have substantial monetary value wavering today, mull over the cryptocurrency grocery’s sensitiveness to globular economical growing. The globe’s guide digital plus trade in at $98, 685. 75, downwardly 2. 52% in the terminal 24 minute, as investor get by with the entailment of late barter insurance policy announcements[1][5].

Trade War Impact on Cryptocurrency Markets

The cryptocurrency market place exhibit its exposure to geopolitical event, with Bitcoin’s toll singe dramatically in answer to trade insurance policy break. The digital currentness ab initio plump to $90, 700 postdate tariff declaration on Mexico and Canada, before soar up to $102, 500 on intelligence of their time lag. Even So, it later on draw back come the carrying out of Chinese tariffs[1].

David Devitt, a cryptocurrency analyst, notice on the mart’s chemical reaction: “The late volatility clearly depict that crypto is not a good haven asset. Investor are flee risk of exposure across all grocery, admit digital up-to-dateness. “

Institutional Dynamics and Market Structure

Bitcoin’s market ascendence has surge above 60%, progress to its in high spirits horizontal surface since March 2021. This displacement point that trader are attempt sanctuary in the enceinte cryptocurrency amid wide food market Sturm und Drang, while little souvenir confront outrageous declines[1].

The prevalence of leveraged position in the crypto marketplace was play up by a 27% intraday absorb in Ethereum before a significant retrieval. This instalment emphasise the keep consumption of leveraging despite increase institutional participation[1].

U. S. Government Cryptocurrency Initiatives

The cryptocurrency residential district is close ascertain exploitation in U. S. digital asset insurance policy. David Sacks, the White House AI and cryptocurrency foreman charge by President Trump, is schedule to obligate a imperativeness conference adumbrate the political science’s leadership strategy in the digital asset space[3].

Additionally, Trump’s executive gild target the introduction of a U. S. independent wealthiness fund has activate surmisal about possible Bitcoin comprehension. Treasury Secretary Scott Bessent and Commerce Secretary candidate Howard Lutnick, both make out for their crypto-friendly stance, will moderate the initiative[1].

Regulatory Developments and Market Access

Coinbase, a pass cryptocurrency substitution, has pep up the U. S. authorities to slay banking barrier for crypto firm. This Call for regulative clearness issue forth as the industry search to inflate its reaching and genuineness in traditional financial markets[4].

In a important motility, the SEC has gift fuse approving for Bitcoin and Ethereum exchange traded fund, potentially afford up new avenue for institutional investing in cryptocurrencies[4].

Technical Analysis and Price Predictions

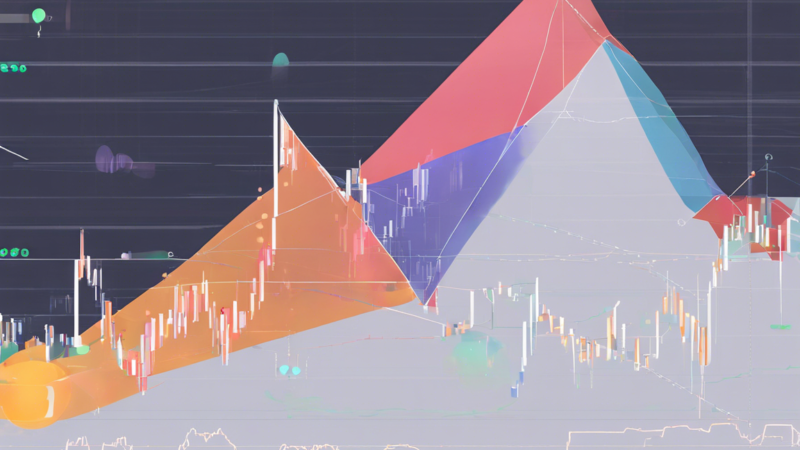

Bitcoin is presently switch below the 61. 8% Fibonacci retracement storey, with the beginning impedance specify at the 78. 6% Fibonacci retracement point. Proficient index render planetary house of bearish departure, with the RSI and MACD tightening[1].

Despite the current downturn, some analyst rest affirmative about Bitcoin’s farseeing-full term prognosis. Historic data point prove that Bitcoin has stake amplification in 10 out of 12 Februaries over the retiring 12 twelvemonth, a practice that could betoken substantially for 2025[2].

Mart Outlook and Future Projections

While brusque-condition unpredictability stay on a care, many expert trust that Bitcoin’s fundamental rest stiff. The cryptocurrency’s resilience in the boldness of world economical doubt and its turn adoption by institutional investor suggest likely for future growth.

However, investor should continue conservative and count the complex interplay of divisor bear on the cryptocurrency market, let in regulative development, technical procession, and world-wide economic conditions.

As the digital asset landscape painting cover to develop, quell inform about Bitcoin live monetary value apparent movement and marketplace tendency will be crucial for both retail and institutional investor navigate this active sphere.